Wealth Inequality is Breaking Us

By Ryan Gifford

Date Posted 3/09/2021

Graph Courtesy of Emmanuel Saez, Gabriel Zucman/taxjusticenow.org

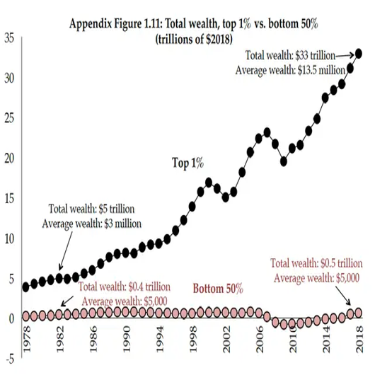

This last week we saw both raising minimum wage and wealth tax legislation in the news, so let's dive in. Often painted as “socialist policies'', I hope to help them not be so easily dismissed. The graph shown above summarizes the broad problem: our collective wealth continues to be consolidated to the very few while the rest of us continue to work and consume to increase their profits. It will continue if we don’t make some changes. It also suggests that policies over the last several decades have worked very well for the top 1% while ignoring the lowest earning 50%. Lets add some more detail to the problem. Wealth has not been this consolidated to the few since right before the Great Depression. Similar with income. This much excess wealth also can cause market bubbles that pop and inevitably hurt the most vulnerable the most.

What does this mean for the lowest earners? The current minimum wage is $7.25 per hour which amounts to a little over $1,000 per month for full time work. That is simply not enough to live on. Is that really acceptable to us as a society? Whether or not it started as enough to live on, minimum wage still hasn’t kept up with inflation or productivity. It should be $10+/hr for inflation if it kept up after 1968 and $24/hr for productivity. National Low Income Housing Coalition estimates what wage is required in each state to afford a two-bedroom rental home. Here in MN, the estimate is $20.53/hr. This ultimately leads to estimates of between 25%-60% of those that are unhoused that are also working.

If you’ve been picturing white people during this discussion so far, BIPOC are more affected by inequality. This brief from Brookings Institute is helpful in providing context. In 2016, the median household net worth was ten times higher for a white household than a black household. Even though black people make up 13.4% of the US population, they make up only 1.9% of the wealthiest households. There are certainly historical elements that contribute to this and are likely worth entire discussions on their own. However, even today black men are paid over 20% less than white men and black women over 10% less than white women even with similar education level and experience. Of course, men and women need to be analyzed separately because there remains a large wage gap based on gender as well.

I’m not going to pretend that these are easy problems to solve or that any solution will be perfect, but we need to do something and the two proposals in the news last week are good positive steps. I found a very helpful article discussing the economics of the wealth tax. The graph posted for this blog was pulled from it. In addition to the climbing wealth inequality, it also outlines that inexplicably in 2018, the wealthiest 400 people paid less percentage of their income in taxes than the bottom 50% of earners in America. The article outlines Elizabeth Warren’s proposal that is estimated to generate $3.75 trillion dollars over a decade or $375 billion per year. It sounds like a lot, but that is simply because the very rich have so much. Far from the socialism many would have you believe it is, it proposes wealth above $50 million is taxed at only 2% and it rises to 6% for wealth above a billion (the current proposal is more modest). Of course, both percentages are well below normal stock market returns. Several of the very wealthy have even said they want to be taxed more. Additionally, the pandemic is highlighting that no dollar is more secure in America than that of the billionaires, who have reportedly raised their wealth by 38.6% or over $1 trillion.

Meanwhile, during the pandemic 8 million people have fallen into poverty. The details of the minimum wage are highlighted above. We simply need full-time work to be enough for people to live. I threw a lot of large dollar figures at you, but I wanted to highlight another. The cost of sheltering the unhoused in our country is estimated to be $20-40 billion per year. This is a drop in the bucket for that $375 billion I just mentioned from the wealth tax. If your instinct is to give privately, I encourage you to continue doing so. I will cover in a future post why we likely need more or a different emphasis for that giving.

I hope this illustrates why these policies are important and why we should all care. When I think about loving my neighbor as myself and try to put myself in their shoes, I think about those working full time and unable to pay their bills and the stress, pain, and disruption that must cause. We have to advocate for one another. Hopefully, this post helps add some information to the discussion and context, but I hope moreso that we can work together to take care of one another.

Ryan Gifford is a white, male, Christian who is a husband to a wonderful woman and father to an incredible son, who understands that these distinctions provide him with significant privilege by our society. He is an engineer with an education in data science who is on a research and faith journey as a recovering Republican and Evangelical. He will share some of these thoughts and research here.